30042022 15052022 for e-filing 5. Latest news from around the globe including the nuclear arms race migration North Korea Brexit and more.

How To File Income Tax For The First Time

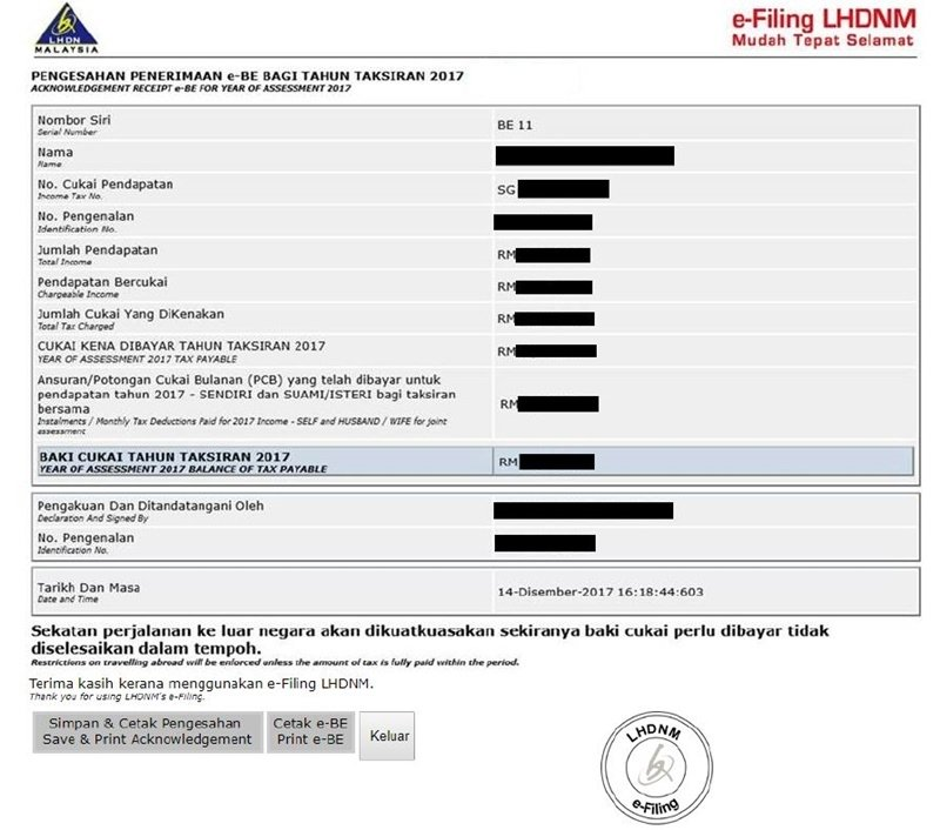

Form BE Income tax return for individual who only received employment income Deadline.

. Individuals who own a property in Malaysia that isnt used for business purposes and receive a rental income are subject to income tax. Fill in the form with your income information according to the relevant categories. This is explained in greater detail under Section 4d of the same Act.

Complete the form using the printed instructions. Asia and the Pacific. How second home owners could save 240k in tax.

Environmentally related tax revenue. Youll need to fill in a separate tax return. Capital Gains Reduction Report.

You can also declare any tax incentives you have received at this step. Time Use by Country Income Level. Find all the latest news on the environment and climate change from the Telegraph.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. The empty string is the special case where the sequence has length zero so there are no symbols in the string. One must file an income tax return to justify hisher income.

However you dont have to memorise all this Simply use the income tax calculator in Malaysia that I recommended KiraCukaimy and itll automatically give your income tax guestimate. As a cash basis taxpayer you generally deduct your rental expenses in the. Malaysia has imposed capital.

Treasury both on income tax returns and on FinCEN Form 114. Including daily emissions and pollution data. This section only applies if you want to calculate your income tax manually.

An increasing proportion of income must be paid in tax as the income increases. Form 4506 has multiple uses and special attention must be taken when completing the form for a gift tax inquiry. Many traders in Japan used both systems declaring profits on the Withholding Tax system and losses as taxable income minimizing the amount of income tax paid.

The form and instructions are available on IRSgov. Citizen with foreign bank accounts totaling more than 10000 must declare them to the IRS and the US. Provide your income details.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Income Tax SlabBrackets Applicable for FY 2019-20. Form B Income tax return for individual with business income income other than.

All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income. Formally a string is a finite ordered sequence of characters such as letters digits or spaces. By adding expenses to the propertys cost base investors can reduce the capital gains they declare on their annual income tax return.

Yonhap news articles produced by building a network covering domestic supplies in various newspapers broadcasting and government departments major institutions major corporations media K-pop K-wave Hallyu Korean Wave Korean pop Korean pop culture Korean culture Korean idol Korean movies Internet media and international agreements of the Republic of. This could lead to a reduction in the amount of CGT required to pay on the sale of the investment property. Income tax is a tax imposed by the government on the income earned by individuals and businesses.

Latin America and the Caribbean. PROFITS TAX -- Tax imposed on business profits in addition to ordinary income tax or as distinct from income tax imposed on other forms of income. You can then declare any donations or gifts that you have received.

In this regard to avail tax advantages to its fullest it is crucial to understand the existing income tax slab for the fiscal year. Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. The second method declaring proceeds as taxable income 申告所得 required individuals to declare 26 of proceeds on their income tax statement.

PROGRESSION -- The rates of individual income tax are usually progressive ie. If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when it was earned. Form 4506 Request for Copy of Tax Return PDF is used to request a copy of previously filed tax returns with all attachments.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Total on-demand streams week over week Number of audio and video on-demand streams for the week ending October 13. In middle income countries youth are more likely to be students wage employed or NEET in low income countries youth are more likely to be self-employed or underemployed.

Income Tax in India has been filed annually based on Previous Year and Assessment year Previous Year. Form used by company to declare employees status and their salary details to LHDN Deadline. If you do not usually send a tax return you can register for Self Assessment to declare any income you have not paid tax on from the last 4 years.

As per Income Tax Act ITA 1967 any person who committed for an offence will be fine either through penalty of imprisonment or both depending on severity or the number of offences. Tamil News Tamil Newspaper Latest Tamil news - Dailythanthi. If youre not sure what counts as income that you have to declare for tax purposes or not scroll down to our section on stating your income below.

31032022 30042022 for e-filing 4. 10 Perkara Wajib Tahu Tentang Cukai Pendapatan LHDN. According to income tax rules Previous Year also known as the Financial Year begins on 1st April of the current year and ends on 31st March of the next year.

If you have never filed your taxes before on e-Filing income tax Malaysia 2022. Cut to income tax in doubt under new Chancellor. The following table is the summary of the offences fines penalties for each offence.

The outdated inheritance tax rules costing families.

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

How To File Your Taxes For The First Time

Oveetha Management Services Income Tax Submission Is Due Very Soon If You Need To Do E Filing For Business Enterprise Income Tax Form B It Can Approach Me For Below

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Income Tax Exemption In Malaysia And How To File E Filing 2022

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Partnership Business In Malaysia 3 Steps To Declare Income Tax If You Re Non Profitable

Understanding Tax Smeinfo Portal

Malaysia Personal Income Tax Guide 2020 Ya 2019

Personal Income Tax Archives Tech Arp

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

The Us Foreign Tax Credit A Guide For Americans Living Abroad Wise Formerly Transferwise

Declare Your Income Tax Now Get A Lower Penalty Rate Speedhome

How To File For Income Tax Online Auto Calculate For You

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My